Drake Tax - 1099-B - Noncovered Securities

Article #: 13580

Last Updated: December 05, 2024

In Drake Tax, there is no data entry field for Box 5, Check if non-covered security. If Box 5 is marked on the taxpayer's Form 1099-B:

-

the broker may, but is not required to, report the following information:

-

Box 1b, Date acquired. Enter on screen 8949, field 1b.

-

Box 1e, Cost or other basis. Enter on screen 8949, field 1e.

-

and Box 2 Type of gain or loss. Enter on screen 8949, field 2.

-

Caution To ensure an accurate tax return, the taxpayer must supply any information missing from 1b, 1e, or 2, or confirm it if it is present.

-

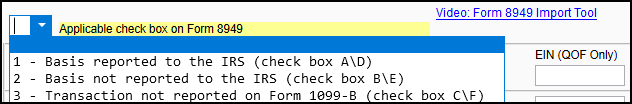

Whether or not required, if that information is reported, then Box 3, Check if basis reported to IRS, is marked. Indicate whether Box 3 is marked on screen 8949, from the Applicable check box on Form 8949 drop list. Select either:

-

1 - Basis reported to the IRS (Check box A\D)

-

2 - Basis not reported to the IRS (Check box B\E)

-

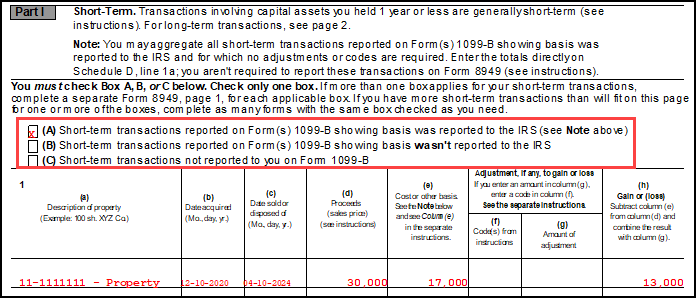

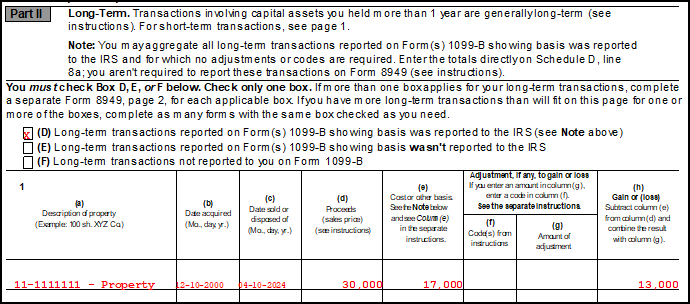

Check boxes A and B refer to short-term transactions displayed on Part 1 of Form 8949 in View/Print mode.

Check boxes D and E refer to long-term transactions displayed on Part II.

See the instructions for Box 5 In the Instructions for Form 1099-B.