Drake Tax - 1099-PATR Data Entry

Article #: 13814

Last Updated: December 05, 2024

For Sub S(1120S), and Partnership(1065) returns, these amounts are entered on field 23, Domestic production activities deduction from cooperatives, of the 8903 screen.

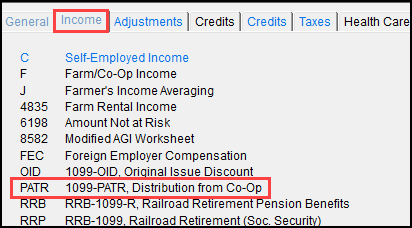

Enter the 1099-PATR information on screen PATR, located on the Income tab in the 1040 and 1041 packages. The PATR screen is not available in other packages.

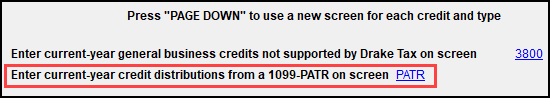

There is also a link at the bottom of the GBC screen on the first Credits tab that takes you to the PATR screen.

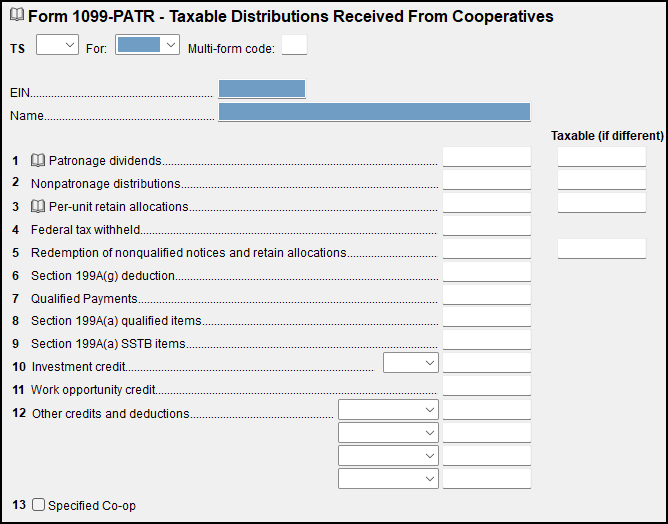

The PATR screen allows you access to all data fields available on the 1099-PATR form.

It also includes:

-

A For drop list for direct distributions to Schedules F and C, or to Form 4835.

-

An MFC (Multi-Form Code) box, allowing you to associate one screen with another. For example, when you have more than one Schedule F and need the 1099-PATR information to flow to the second Schedule F.

-

A drop list for sending investment credit information to Part II or Part III of Form 3468.

-

A drop list for selecting certain credits and deductions.

-

A check box for Specified Co-op.

For more information see the Instructions for Form 1099-PATR.