Drake Tax - 1099-DIV and 1099-INT: Exempt Interest Dividend Not Carrying to State

Article #: 11523

Last Updated: December 05, 2024

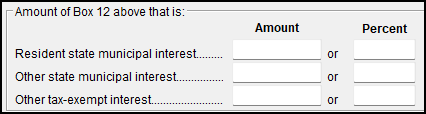

Tax-exempt interest income is reported on box 12 of Form 1099-DIV (box 11 in 2021 and prior, or box 10 in 2018 and prior). Enter the amount of exempt-interest dividends in the applicable box on the DIV screen.

To indicate a breakdown of the interest from line 11 for state purposes, use the fields available at the bottom of the DIV screen.

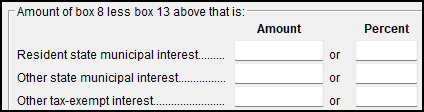

Tax-exempt interest income is reported on box 8 of Form 1099-INT. Enter the amount of exempt interest in field 8 on the INT screen.

To indicate a breakdown of the interest from line 8 for state purposes, use the fields available at the bottom of the INT screen.