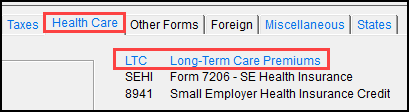

Drake Tax - Long-Term Health Care Premiums

Article #: 13806

Last Updated: December 05, 2024

Important Self-Employed taxpayers should use the SEHI screen to record LTC premiums as applicable.

A "Long-Term Care Premiums" link to the LTC screen is also available on the A screen (on the General tab) under Medical and Dental expenses.

Note:

-

If premiums were paid for the taxpayer or spouse, type the amount(s) paid in the first and/or second fields respectively.

-

If the amounts were paid for a dependent, select the dependent from the drop list beginning with the third field and press Enter. The dependent’s name fills in automatically. Then enter the applicable premiums.

-

Any amount not deductible on Form 1040 is carried to the Schedule A.

-

The program applies a limit based on the age of the person as entered on screen 1 for the taxpayer and spouse, or screen 2 for dependents.

-

If you have entered long-term care insurance premiums on the SEHI screen, do not duplicate entries on the LTC screen.

The above information is for entering Long-Term Care Premiums, however, if the taxpayer/spouse received a form 1099-LTC reporting Long-Term Care Benefits, screen 8853 may be needed. Review the 8853 Instructions and filing guidelines for more information.