Drake Tax - 1099-NEC - Nonemployee Compensation

Article #: 16952

Last Updated: December 05, 2024

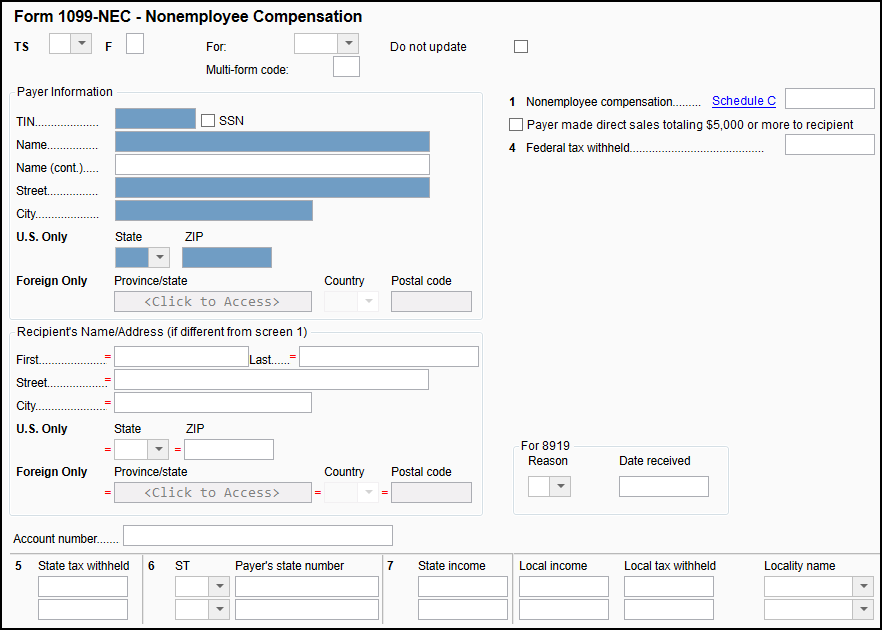

Non-employee compensation is reported on Form 1099-NEC, line 1, not on Form 1099-MISC, line 7. More information may be found in Form 1099-NEC Instructions.

Form 1099-NEC is located on the General tab of data entry on screen 99N. There is also a link on the 99M screen, in the top left hand corner, that goes directly to the 99N screen. Since Form 1099-NEC can be used to report income from a variety of sources, on screen 99N in the For drop list you must indicate whether you want the income to flow to:

-

Schedule 1, line 8, Other income

-

Schedule C, Profit or Loss from Business

-

Schedule F, Profit or Loss from Farming

-

Form 8919, Uncollected Social Security and Medicare Tax

Use the Multi-form code field to enter the correct schedule or form, if more than one is present in the return (if no entry is made, then it defaults to the first form). To have the software produce a list of all 99N screens that have been used in the software, go to Setup > Options > Form & Schedule Options tab and select a value for 1099-NEC list if greater than.

Note Note: Entering data on screen 99N will not create Form 1099-NEC in View/Print mode.