Drake Tax - 1099-C: Cancellation of Debt and Form 982

Article #: 11715

Last Updated: November 03, 2025

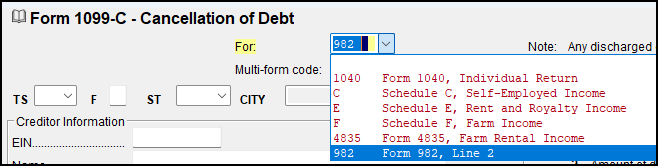

Enter this information on screen 99C. If the amount is a discharged debt that is excludable from gross income, it should also be reported on Form 982. In that case, select 982 from the For box drop list on the 99C screen, and also complete the 982 screen.

If the amount on your 1099-C is discharged debt that is excludable from income and should show on Form 982 and not on the Schedule 1, line 8 as income:

-

Verify 982 is selected in the For field on the 99C screen.

-

Verify that all applicable fields have been completed on the 982 screen. A link to Form 982 is available on the 99C screen (directly beneath line 7 at the right of the screen).

To learn more see IRS Topic 431 - Canceled Debt - Is It Taxable or Not?

Student Loan Forgiveness

Per Notice 2022-01, "When all or a portion of a student loan is discharged after December 31, 2020 and before January 1, 2026, an applicable entity is not required to, and should not, file a Form 1099-C information return with the IRS or furnish a payee statement to the borrower under section 6050P as a result of the discharge." For more information, see the Instructions for Lenders and Loan Servicers Regarding Certain Discharged Student Loans.