Drake Tax - NY: Military Personnel

Article #: 14158

Last Updated: December 05, 2024

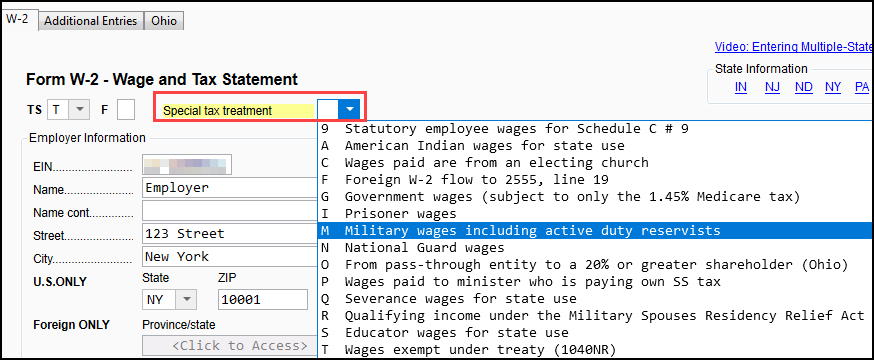

If you are a New York State resident as well as military personnel, your military pay is taxable on your New York State return in the same way it is taxable on your federal return. In Drake, military wages can be indicated on the federal W2 screen with a Special Tax Treatment code of M - Military wages including active duty reservists.

If you are a member of the NYS organized militia, you may be entitled to a New York subtraction. New York State organized militia income will show on the taxpayer's federal W2 screen in Box 14 with a code of MNA. The program will carry this amount to the subtractions from income section of the NY return if the Special Tax Treatment code for the federal W-2 is N.

If the taxpayer included in their federal AGI military pay that was received for active service as a member in the armed services of the United States in an area designated as a combat zone, the combat pay can be subtracted from NY taxable income.

Requirements:

-

Combat Zone information must be entered on federal screen MISC.

-

The Special Tax Treatment box on screen W2 contains one of the following:

-

M - Military wages including active duty reservists

-

N - National Guard wages

or

-

-

If only a portion of the income is applicable, make adjustments on NY screen 4.

For more information on NYS military personnel, see the NY screen FAQ, item F inside Drake tax data entry, or NY Publication 361.