Drake Tax - NY - Federal Form 8915-F and NY Pension Exclusion

Article #: 17598

Last Updated: November 03, 2025

-

Form IT-201 line 26 (or IT-203 line 25) - Pensions of New York State and local governments and the federal government (referenced as NY State/Govt Pension in this document)

-

To qualify for full exclusion, the pension must be from a New York State local government pension plan or a federal pension plan. This subtraction modification is allowed regardless of your age, and applies to pension income included in your recomputed federal adjusted gross income.

-

-

Form IT-203 line 29 (or IT-203 line 28) - Pension and annuity income exclusion (referenced as NY Penson Exclusion in this document). The maximum amount that can be reported on this line is $20,000 per spouse.

-

If your pension is taxable to New York and you are over the age of 59 ½ or turn 59 ½ during the tax year, you may qualify for a pension and annuity exclusion of up to $20,000. This exclusion from New York State taxable income applies to pension and annuity income included in your recomputed federal adjusted gross income.

-

Data Entry

This income is not reported on a 2021 or 2022 federal Form 1099-R. Instead, it is reported on federal Form 8915-F. The taxable amount that is included in the federal adjusted income for the current tax year is determined using the distribution and repayment amounts entered on federal screen 915X.

The options below must be marked on federal screens 915F and 915X

Screen 915F

-

Calendar year in which the disaster occurred.

-

Coronavirus - Mark this box if a 2020 disaster distribution was made for Coronavirus in 2020

Screen 915X

-

Calendar year in which the disaster occurred

Income Excluded

Note Pension Distributions (Other than IRAs) can be excluded on the NY return as NY State/Govt Pension or a NY Pension Exclusion.

IRA Distributions can only be excluded on the NY return as a NY Pension Exclusion.

Pension Distributions (Other than IRAs)

The software will exclude the taxable amount as a NY Pension Exclusion on the NY return by default (not as a NY State/Govt Pension). This means that the taxable amount (with the amount limitation described above) will be excluded only if you (or the decedent) are over the age of 59 ½ or turned 59 ½ during the tax year.

Drake is unable to default to a full exclusion as a NY State/Govt Pension because there is no way to indicate on federal screen 915F or 915X that this income is from a NY state/local or federal government pension plan.

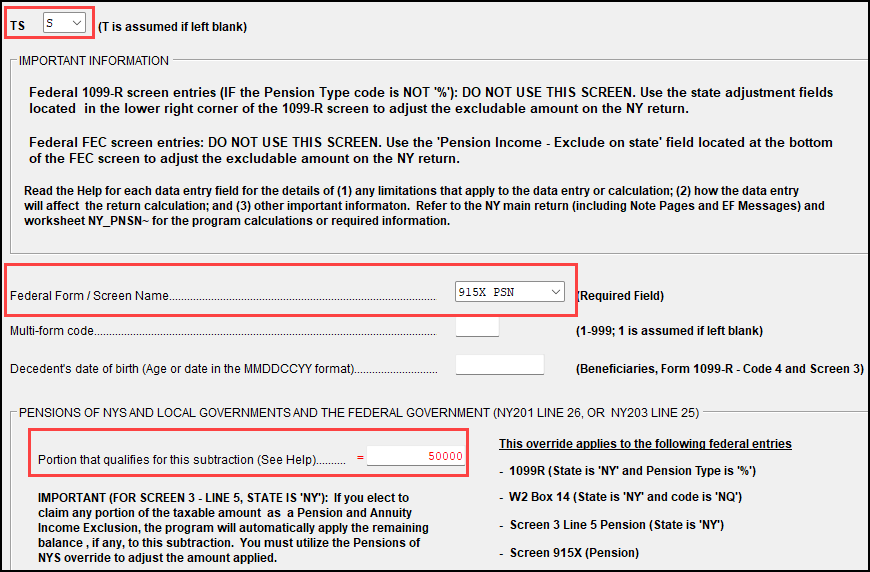

Use NY screen PNSN, available from the NY data entry menu, to override the software’s default calculation.

-

By default, the software will only exclude $20,000 as a NY Pension Exclusion on the NY return.

-

To indicate that this income is eligible to be fully excluded on the NY return as a NY State/Govt Pension, complete screen PNSN as shown below.

Example: Screen 915X has been entered for the spouse on the return, and the Pension Distribution that is included in the federal adjusted income is $50,000 (i.e., the taxable amount included on federal 1040, line 5b). The spouse’s age is 63, this income is from a NY State/Govt Pension plan, and this income is eligible to be fully excluded on the NY.

IRA Distributions

The software will exclude the taxable amount (with the amount limitation described above) as a NY Pension Exclusion on the NY return only if you (or the decedent) are over the age of 59 ½ or turned 59 ½ during the tax year.

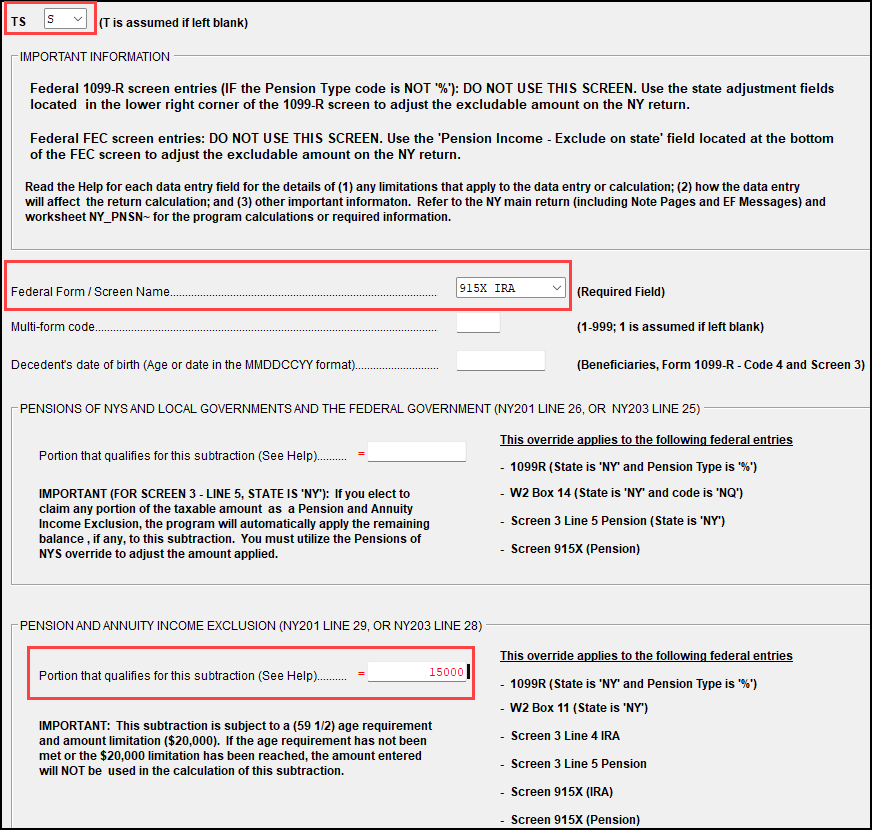

Use NY screen PNSN, available from the NY data entry menu, to override the software’s default calculation.

-

By default, the software will exclude $20,000 as a NY Pension Exclusion on the NY return.

-

To indicate that only $15,000 is eligible to be excluded on the NY return as a NY Pension Exclusion, complete screen PNSN as shown below.

Example: Screen 915X has been entered for the spouse on the return, and the IRA Distribution that is included in the federal adjusted income is $50,000 (i.e., the taxable amount included on federal 1040, line 4b). The spouse’s age is 63, this income is not from a NY State/Govt Pension plan, and only $15,000 of this income is eligible to be excluded on the NY return.