Drake Tax - NY - START-UP NY Program Wage Exclusion

Article #: 16127

Last Updated: December 05, 2024

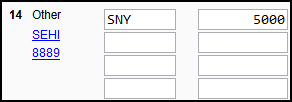

According to the New York Department of Revenue, eligible employees may be able to exclude all or part of their wages from an approved START-UP NY business. These wages are reported on a W-2 and are taxable for federal purposes. If they are eligible to exclude an amount, enter the applicable amount on the W2 screen in box 14 with code SNY.

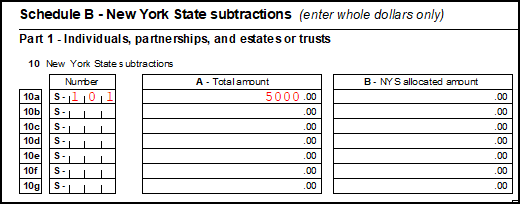

This will flow to the NY225, page 2, Schedule B, part 1 as subtraction number 101 and then to the NY201.PG2, line 31 along with any other subtractions from NY Form IT-225, line 18.

Per the NY DOR:

"Eligible employees of approved START-UP NY businesses may be able to exclude all or part of their START-UP NY wages from New York personal income tax, including:

-

New York State personal income tax;

-

New York City resident income tax;

-

Yonkers resident income tax surcharge; and

-

Yonkers nonresident earnings tax.

Note The wage exclusion tax benefit is for New York State income tax only - It does not apply to federal income tax. Therefore, START-UP NY wages are subject to federal income tax.

To be an eligible employee, you must:

-

be notified by your employer that your job qualifies for the wage exclusion benefit;

-

be engaged in work performed exclusively at an approved business location within a tax free NY area during the calendar year; and

-

be employed at the approved business location within the tax-free NY area for at least one half of the calendar year (183 days). If you are a newly hired employee, this means you must begin work on or before July 1 to meet this requirement for the year."