Drake Tax - NY: Disregarded Entity - IT-204-LL

Article #: 14173

Last Updated: December 05, 2024

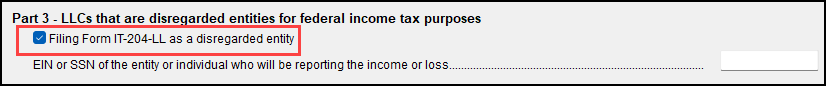

In Drake Tax, you can indicate that a NY IT-204-LL will be filed as a disregarded entity within the NY data entry. Click on the Other tab on the top right of the screen and select screen 204L. In Part 3 of this screen, you will see the indicator declaring that the entity is Filing Form IT-204-LL as a disregarded entity, as well as an entry point for the EIN or SSN of the entity or individual who will be reporting the income or loss.