Drake Tax - 1040: Medicare Premiums Not Flowing

Article #: 10133

Last Updated: December 05, 2024

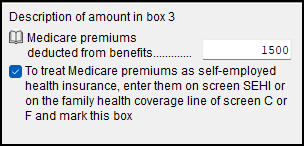

Checking this box on screen SSA only prevents the Medicare premiums from being deducted twice on the Schedule A, line 1.

This does not carry any amount to the Schedule C or F or Form 1040. If applicable, you will also need to either:

-

Enter the Medicare premiums on the Family Health Coverage line of screens C or F.

-

Enter the Medicare premiums on the SEHI screen.

This will allow the amount to be considered for the Self-employed health insurance deduction that shows on:

-

Form 1040, Schedule 1, line 17 (Drake21 and future)

-

Form 1040, Schedule 1, line 16 (Drake19 and Drake20)

-

Form 1040, Schedule 1, line 29 (Drake18)

-

Form 1040, line 29 (Drake17 and prior)