Drake Tax - 8615: Kiddie Tax - Dependent Income

Article #: 10806

Last Updated: December 05, 2024

Generally, Kiddie Tax is the calculation of tax on unearned income amounts over a threshold (varies by tax year) for persons under the age of 18. See the 8615 Instructions for details on who must file Form 8615 to calculate Kiddie Tax. More details for each year of Drake Tax are available below. An export from the parent's return to the child's return is available in some years of Drake Tax.

Per the 8615 Instructions, Form 8615 must be filed for any child who meets all of the following conditions:

-

The child had unearned income in excess of the yearly threshold amount:

-

$2,500 in Drake23

-

$2,300 in Drake22

-

$2,200 in Drake21 and Drake20.

-

-

The child is required to file a tax return.

-

The child either:

-

Was under age 18 at the end of 20YY,

-

Was age 18 at the end of 20YY and didn’t have earned income that was more than half of the child's support, or

-

Was a full-time student at least age 19 and under age 24 at the end of 20YY and didn’t have earned income that was more than half of the child's support.

-

-

At least one of the child's parents was alive at the end of 20YY.

-

The child doesn’t file a joint return for 20YY.

If the child also had earned income such as that from wages, tips, self-employment, paper routes, etc. the instructions provide additional guidance as to what amount needs to be used for Form 8615, line 1.

Note that "...unearned income includes only amounts ...[included] in gross income. Nontaxable unearned income, such as tax-exempt interest and the nontaxable part of social security and pension payments, isn’t included in gross income.'

Use the 8615 screen to make necessary entries, or use the Kiddie Tax export (detailed below) to export data from the parent's return to the child's return.

Notes on calculating the Kiddie Tax (all years)

-

Review Wks 8615 in View/Print mode when the net unearned income amount exceeds the threshold amount.

-

The tax rates are applied to each income range as indicated by the IRS worksheet and guidelines.

-

Depending on the regular or alternate calculation (Drake18 and 19 only), verify the tax rate based on the parent's tax rate or the estate/trust brackets, respectively.

-

If the net unearned income amount does not exceed $2,200, Form 8615 is not required and neither the form nor the worksheet will be produced.

Important If a Wks 8615 is generating erroneously on a return, ensure that the date of birth for the taxpayer on federal screen 1 is entered and accurate.

Kiddie Tax Export Utility

The 8615 Export Utility allows you to export a parent's data to a child’s Form 8615 using the 8615 Export button in View/Print mode. The process consists of two steps:

-

Export the parent's information.

-

Import the parent's information into the child's return.

The 8615 Export button appears in the parent's return in View/Print mode when there is a dependent that is a son, daughter or stepchild that is either under 18 or over 18 and a student.

Leave screen 8615 blank in the parent's return. It has nothing to do with the export.

Export the Parent's Information

-

On the View/Print toolbar, click the 8615 Export button.

-

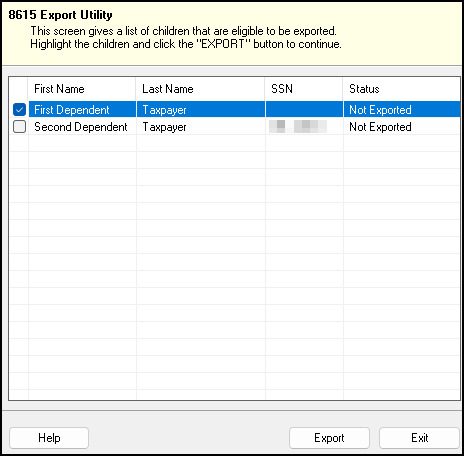

The Export 8615 dialog box lists the son, daughter or stepchild names, SSNs and export statuses for the return:

-

Select the boxes for the dependent(s) for whom you want the parent’s data exported.

-

Click Export. Click OK on the popup confirming the export.

-

Click Exit to close the Export 8615 dialog box. The parent's information is now ready to be imported into the child's return.

Import the Parent's Information into the Child's Return

After the 8615 data has been exported from the parent's return, you will be prompted to import the data the next time you open (or when you create) the child's return. To import parent's data into the child's return:

-

From the Home window, click Open/New.

-

Enter or select the dependent’s SSN and click OK. You are asked if you want to import the return data from the 8615 import file.

-

Click Yes. The return is opened to the General tab of the Data Entry Menu. When you open the 8615 screen, you see the parent's information in the applicable fields.

-

Form 8615 is not generated in the child's return until the investment income (above the threshold) is entered there.

To export Form 8615 data for a dependent who was 18 during the tax year:

-

Open the client's return and open screen 2 to the dependent.

-

Select the option Over 18 and a student.

-

Go to View/Print mode and export the 8615.

-

Open the dependent's return.

-

Import the file when prompted.

-

Open screen 8615 to confirm the import.

-

Open the client's return again and open screen 2 to the dependent.

-

Clear the option Over 18 and a student.

Note: Drake Tax only carries over a gain from the parent’s return. Losses are limited to zero. See the Instructions for Form 8615, lines 8 and 9, for more information.