Drake Tax - 1040: Wage or Distribution and Withholding Verification Fields

Article #: 10932

Last Updated: December 05, 2024

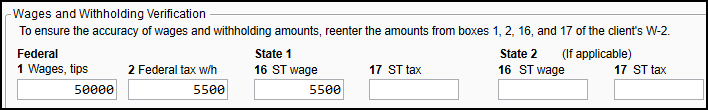

The option Activate W2 wage and federal withholding verification fields can be enabled under Setup > Options > Data Entry. This will allow you to re-enter the amounts from boxes 1, 2, 16, and 17 at the bottom of the W2 screen or boxes 1, 2a, 4, 12 and 14 at the bottom of the 1099-R screen to help ensure that you have not made a typo in one of the fields at the top of the screen.

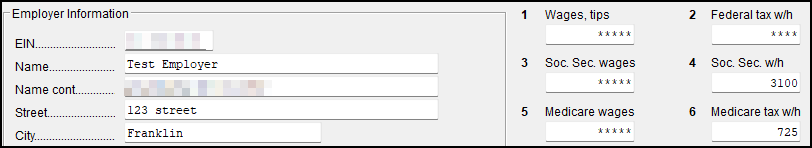

This is the display on the W2 screen:

For W2 entries, EF Messages 5477, 5478, 5501, and/or 5503 will generate if either an amount has not been entered in the verification field(s), or if an amount entered does not match with the corresponding field. To clear these EF Messages, return to W2 data entry and verify that the amounts entered on the W2 screen in both locations match. The fields on the W2 screen will be hidden (as seen above in asterisks), so use the amounts from the printed Form W-2 to verify the amounts entered.

For 1099-R entries, EF Messages 5682, 5683, 5684, 5685, and/or 5686 will generate if either an amount has not been entered in the verification field(s), or if an amount entered does not match with the corresponding field. To clear these EF Messages, return to 1099 data entry and verify that the amounts entered on the 1099 screen in both locations match. The fields on the 1099 screen will be hidden (as seen above in asterisks), so use the amounts from the printed Form 1099-R to verify the amounts entered.

Note Verification fields are only available for two states. If there are more than two states listed on the W2 or 1099-R, only enter verification for the first two listed. Use caution and manually double-check any other entries.