Drake Tax - 56: Notice Concerning Fiduciary Relationship

Article #: 12492

Last Updated: December 05, 2024

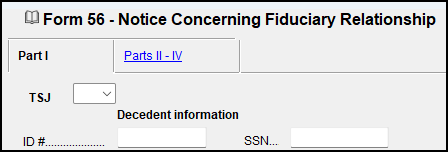

To prepare a Form 56 within a 1040 return, click on the Other Forms tab and select screen 56. Due to IRS changes in Form 56, beginning in Drake15, this form is now completed using a tabbed screen, which can be found at the top of screen 56.

Important Form 56, Notice Concerning Fiduciary Relationship, cannot be e-filed with the 1040 return. It must be transmitted separately.

Form 56 can only be filed from the current year software.

Form 56 can only be e-filed if completed for the primary taxpayer (EF Message 5728 prevents IRS reject F56-052).

In order to e-file Form 56, complete the following steps (which are available in Screen Help for screen 56):

-

Complete screen 56 in data entry, accessible from the Other Forms tab.

-

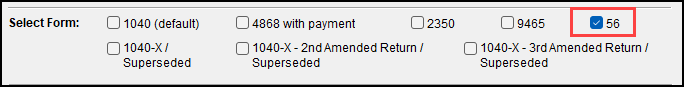

On the PIN screen in the Select Form section select 56.

-

At the bottom of the PIN screen, enter the taxpayer’s Prior-Year AGI and PIN.

-

Open the EF screen (General tab) in data entry and select 56 under FEDERAL E-FILE OVERRIDE.

-

Calculate the return.

-

From the Home window of the software, choose Select Returns for EF from the EF menu.

-

Verify that Form 56 displays under the EF Documents column.

-

Select the line for Form 56 and continue the transmission process.

For more information about filing a Form 56, see the Form 56 Instructions.

Note If an extension EXT screen exists in the return, it may need to be deleted (press Ctrl+D) before selection of Form 56 is possible under EF > Select Returns for EF.