Drake Tax - Additional Medicare Tax: Form 8959

Article #: 12482

Last Updated: December 05, 2024

This tax became effective in 2013 and is reported on Form 8959, Additional Medicare Tax.

The 0.9% Additional Medicare Tax applies to an individual’s wages, Railroad Retirement Tax Act compensation, and self-employment income that exceed a threshold amount based on the individual’s filing status.

The threshold amounts are:

-

$250,000 for married taxpayers who file jointly

-

$125,000 for married taxpayers who file separately

-

$200,000 for all other taxpayers

An employer is responsible for withholding the Additional Medicare Tax at 0.09% from wages or compensation it pays to an employee in excess of $200,000 in a calendar year. Per the 8959 Instructions: "Your employer must withhold Additional Medicare Tax on wages it pays to you in excess of $200,000 for the calendar year, regardless of your filing status and regardless of wages or compensation paid by another employer." Form 8959 reconciles the information.

Data Entry

Form 8959 will be generated in view mode based on entries made on the W2 and C screens.

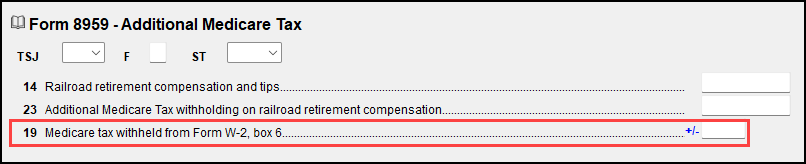

Screen 8959 can be used to enter railroad retirement compensation and tips as needed for Form 8959 calculations.

There is an adjustment field for line 19 at the bottom of the 8959 screen, located on the Taxes tab, to address rounding issues that arise when entering multiple Forms W-2. You may enter a one digit adjustment here to change the amount shown on the Form 8959 in View/Print mode.

The software will calculate the amount that should have been withheld on screen W2, box 6 if box 1 wages, tips is greater than $200,000, however, you should verify that this amount is the same as what the employer actually reported on Form W-2. For example, the amount entered on box 1 is $250,000, the amount in box 6 will be (0.0145*250,000) + (0.009*50,000) = 4075. If the employer did not withhold $4075, enter the amount actually withheld instead. See Publication 80 for details.