Drake Tax - NYC: NYC3L Schedule E and Alternative Tax Not Working

Article #: 11215

Last Updated: December 05, 2024

If the S corporation qualifies as an eligible small firm for New York City, it is not required to complete Schedule E or carry the results forward from the Alternative Tax Worksheet.

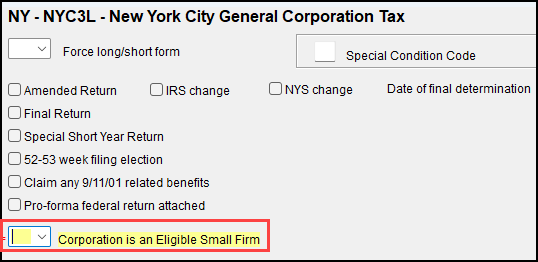

To get the info to flow, select No from the drop list on screen 3L1, for the override field Corporation is an Eligible Small Firm. The Help screen for that field describes the eligibility requirements.