Drake Tax - NY: IT-360.1 Change of City Resident Status

Article #: 14143

Last Updated: December 05, 2024

Form IT-360.1, Change of City Resident Status, should be used when the taxpayer or spouse is a part-year resident of New York City (NYC) or Yonkers.

If Form IT-360.1 is not producing in the View/Print mode, check the following items:

-

The resident city on the federal screen 1 must be PY. The resident state must be NY or PY. Full year residents or non-residents of NYC or Yonkers cannot file Form IT-360.1.

-

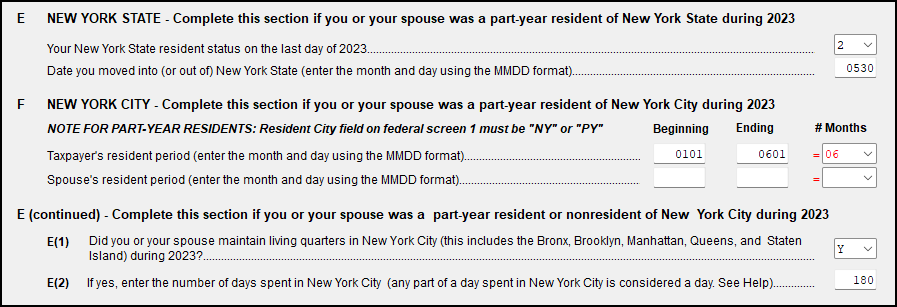

The dates of residence for NYC and/or Yonkers for the taxpayer and/or spouse must be entered on NY screen 1, to reflect the changed city residence during the tax year. If NY is the resident state on federal screen 1, enter the beginning and ending residence dates on section F. If PY is the resident state on federal screen 1, enter the residence information on section E and section F.

If Form IT-360.1 is not producing in the View/Print mode of Drake Tax 2022, check the following items:

-

The resident city on the federal screen 1 must be PY. The resident state must be NY or PY. Full year residents or non-residents of NYC or Yonkers cannot file Form IT-360.1.

-

The dates of residence for NYC and/or Yonkers for the taxpayer and/or spouse must be entered on NY screen 1, to reflect the changed city residence during the tax year.

-

The Nonresident County Lived in must be entered on NY screen 15 . If the move was in or out of NY state then enter NR.

-

The T/S/J code at the top of NY screen 15 must match the city residence dates on NY screen 1. For example, if the taxpayer is a full year NYC resident and the spouse is a part year resident, the code on screen 15 should be S not T.

See the Instructions for Form IT-360.1 for more information.

If you have set pricing per form for Form NY 360.1, each page of the form will be listed on the bill. Since there are three pages to Form NY 360 it will shows three times (per taxpayer). Consider this functionality when setting your form pricing under Setup > Pricing.