Drake Tax - 1040: Amounts Updating to ES Screen

Article #: 14487

Last Updated: December 05, 2024

When estimated tax vouchers are produced in the prior year, the amounts are updated to the next year in the 2024 Estimated Taxes Already Paid for This Year section. Estimated payment vouchers are automatically produced when required (see Drake Tax - Printing Estimate Vouchers and Entering Estimates Paid). This means that if estimated payments were required for the taxpayer(s), estimates were produced in View/Print mode and Return Note 483 was generated.

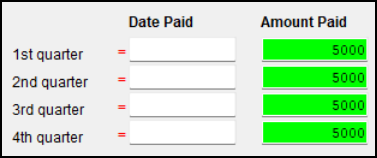

When updating the return to 2024, the amounts included on the estimated vouchers in 2023 are updated and flagged for review:

The software assumes that when estimated vouchers are required and produced, that the amounts were paid. If the estimates were not paid, or different amounts were actually paid by the taxpayer(s), remove or change the flagged amounts on the updated ES screen.

Note

There is a global setup option at Setup > Options > Form and Schedule Options > Print ES vouchers only when screen ES indicates that prevents the software from automatically generating estimated vouchers.

If this option was selected, ES vouchers were only generated when entries were made on the ES screen to produce vouchers (by a selection from the ES Code drop list or an amount entered in the Estimate amt column).

All amounts printed on vouchers last year will be updated to the ES screen in the current year of Drake Tax, regardless of the selection at Setup > Options in the previous year of Drake Tax.