Drake Tax - PA - 1120S/1065 - Apportioning or Allocating Income

Article #: 15661

Last Updated: December 05, 2024

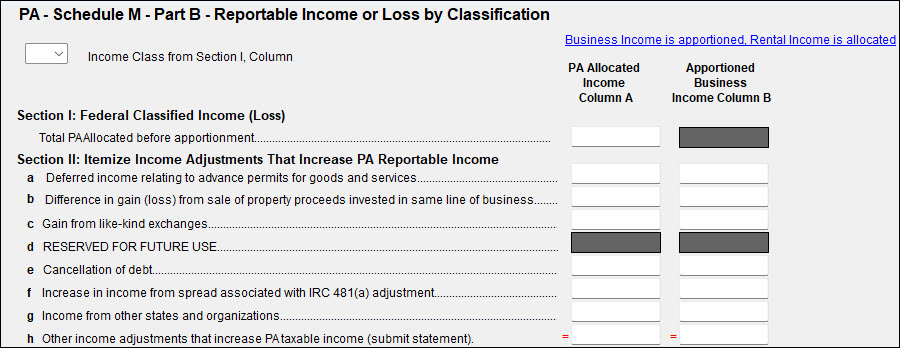

For the 20S65 purposes, business income is always apportioned while rental income is always allocated. According to the PA Bureau of Taxation, this rule has no exceptions. The PA Bureau of Taxation explains that the income’s reporting classification should be viewed as the primary determinant as to whether an entity’s income should be apportioned or allocated. Rental income is reported on the Pennsylvania Schedule E, a form that requires allocation. Business income meets Pennsylvania’s definition for a “commercial enterprise” (whether a business provides goods or services) and, in order for income to be apportioned, this test must first be satisfied. As such, business income is always apportioned. If you attempt to allocate business income, the program will generate a separate copy of this schedule and it will then classify this amount as rental income since only rental income is allowed to be allocated.

Unless your client’s return has both rental and business income, the rental income will not be apportioned and business income will not be allocated. With this knowledge in mind, do not attempt to use PA screen M2 to enter business income within the PA Allocated Income column or enter rental income with the Total Business Income column:

For more information, review the following links: