PA - 20S65 - K1P Rental Income on Schedule E

Article #: 16834

Last Updated: December 05, 2024

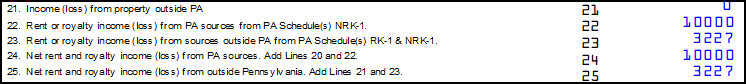

Schedule K-1 Rental Income from Pennsylvania and other state sources are reported on the PA Schedule E, lines 22 and 23. Drake Tax makes the following assumptions when determining how to handle this income:

-

The income was earned by a non-resident (NRK-1)

-

The income is Pennsylvania source income

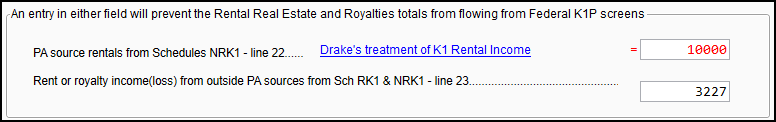

If this is not accurate to the facts of the return, adjustments can be made by going to PA data entry > screen E, Sch E Rents and Royalties. An entry in either field prevents Rental Real Estate and Royalties from flowing to PA from the federal K1P screen(s):

Note If the property is not listed on federal screen 8825, select the Additional property not listed on federal 8825 check box at the top of PA screen E.

Entries made on these fields will carry to the PA Schedule E, lines 22 and 23, respectively.

For more information, review the PA Instructions.