Drake Tax - PA: 1120-S/1065 Schedule D Part II or IV Blank

Article #: 12789

Last Updated: December 05, 2024

In-State Capital Gain or Loss

The PA Schedule D-II (PASCHD.PG2 in View/Print mode) remains blank unless both of the following conditions are met:

-

There is an in-state capital gain or loss, and

-

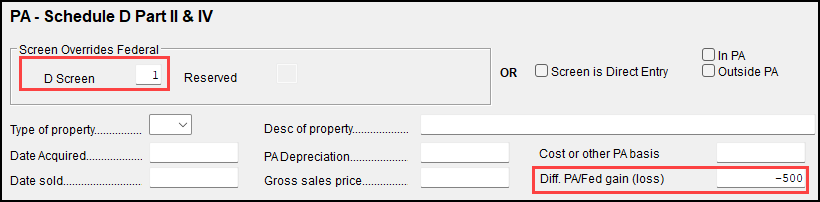

On PA screen D2, a difference between the federal and PA schedules D is entered, and the federal D screen is identified:

Out-of-State Capital Gain or Loss

The PA Schedule D-IV (PASCHD.PG4 in View) remains blank unless both of the following conditions are met:

There is an out-of-state capital gain or loss, and

On PA screen D2, a difference between the federal and PA schedules D is entered, and the federal D screen is identified:

For more information, see the Instructions for Form PA-20S/PA-65.