Drake Tax - Facts About Refundable Credits Due Diligence

Article #: 14268

Last Updated: December 05, 2024

The IRS requires a Due Diligence form that allows for documentation of preparer and client answers for the following credits:

-

Earned Income Tax Credit (EITC)

-

Child Tax Credit (CTC)

-

Additional Child Tax Credit (ACTC)

-

Other Dependent Credit (ODC)

-

American Opportunity Tax Credit (AOTC)

According to Publication 4687, there are 4 requirements for Due Diligence:

-

Compute the credits based on the facts.

-

Complete and Submit Form 8867.

-

Keep records.

-

Ask all the right questions

Drake provides assistance with the 4th requirement through the Dependents, 8867, DD1 and DD2 screens. All four screens can be located in data entry of a client return on the General tab. Each screen can assist with a different portion of the Due Diligence requirements. You can print blank copies of the due diligence questions from Tools > Blank Forms - search for "Due Diligence."

See the video https://support.drakesoftware.com/Video/due-diligence-overview.

Screen 2

In the full Item Detail of this screen, the center section has questions that relate to each dependents martial status, tie breaker rules and residency/disability documentation. These questions would need to be answered for each dependent qualifying for any of the refundable credits mentioned previously.

8867 - Due Diligence Checklist:

Form 8867 covers the EIC, the AOTC, and the CTC/ACTC/ODC interview questions.

DD1 screen

This screen is broken into tabs:

Child - This tab has available questions for the Age, Relationship and Residency portions of Due Diligence. Each child can be selected in the Qualifying Child drop down at the top of the screen. Only children who have been entered on screen 2 - Dependents will appear in this drop down menu.

Income - This tab allows for the preparer to document whether the income is sufficient to support the client's household, as well as questions for Self-Employed persons. Four income tabs are available starting with Drake Tax 2023 to help with documentation if the taxpayer/spouse has more than one Schedule C business. If there is only one business, be sure to enter the details on the Income tab and only use the other tabs (2nd Business Income, 3rd Business Income, 4th Business Income) if there are other businesses.

Head of Household - If the filing status of the return is Head of Household, this tab can be used to answer questions for the Marriage test, Qualifying Person test and Cost of Maintaining a Home test.

DD2 screen

In order to facilitate the preparer documenting the specific inquiries and responses and to allow them to be maintained electronically with the rest of the taxpayer data, this Due Diligence-specific note screen allows the preparer to record:

-

Of whom were the inquiries were made.

-

The date of the inquiries.

-

The questions asked.

-

The answers to the questions.

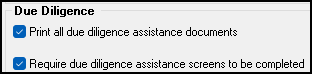

While the IRS does require by law that any person paid to prepare tax returns, claiming one or more of the above mentioned credits, to complete all 4 steps of the Due Diligence requirements, Drake does not require that these forms be completed. If you choose not to prepare these forms through Drake, you can turn off the Due Diligence requirements to allow for e-file. To do this, from the main page of Drake Software, go to the Setup menu > Options > Administrative Options tab and uncheck the Due Diligence boxes.

Caution Failure to comply with IRS Due Diligence requirements can result in penalties, expulsion from the IRS e-file program, and/or other repercussions. See Publication 4687 for more information. Preparers must consult IRS guidelines to ensure that all record keeping requirements are met as the questions provided are not all inclusive of IRS requirements.

For more information about Refundable Credit Due Diligence, see Publication 4687.